Quick Brief

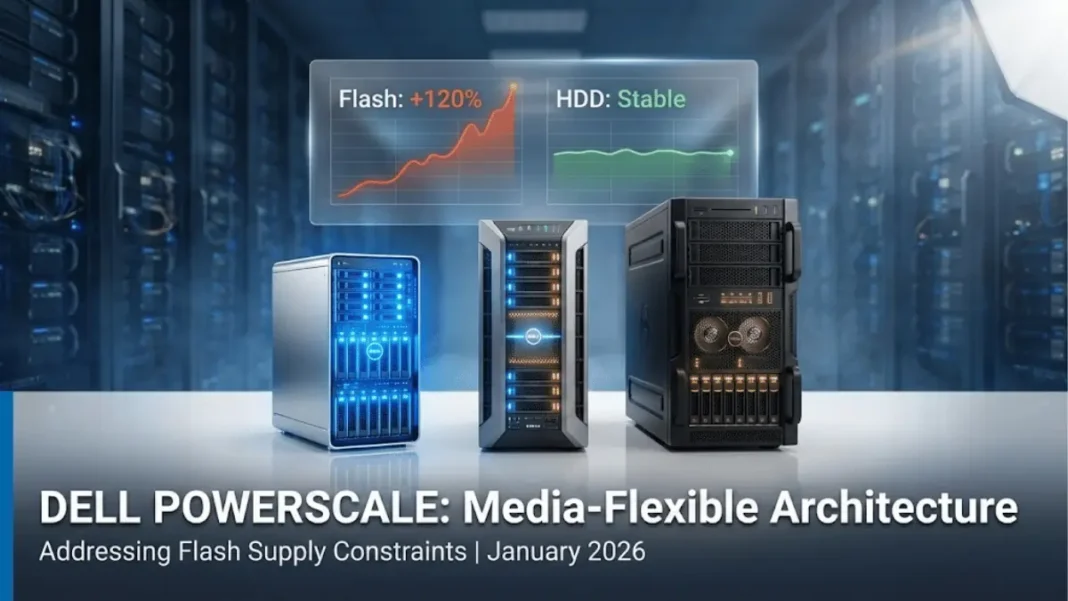

- The Crisis: Flash prices climb 60–120% as AI workloads consume enterprise-grade NAND, tightening availability and extending lead times industry-wide.

- Dell’s Strategy: PowerScale’s media-flexible architecture enables automatic tiering across NVMe, hybrid, and HDD nodes eliminating single-media dependency during supply disruptions.

- Market Shift: The flash-to-HDD cost ratio expands from 1:4 to 1:10 in 2026, forcing enterprises to re-evaluate flash-only infrastructure assumptions.

- Competitive Pressure: Flash-only vendors including VAST Data and Pure Storage lack cross-media tiering capabilities, amplifying cost exposure and supply vulnerability.

Dell Technologies positioned its PowerScale storage platform to address accelerating flash supply constraints, as AI workloads fundamentally reshape demand for enterprise-grade NAND. The announcement, published January 22, 2026 by David Noy, Vice President of Product Management for Unstructured Data Solutions, directly challenges flash-only architectures as the data infrastructure market enters a structural supply-demand shift.

Flash Pricing Reaches Critical Inflection Point

Flash prices climb 60–120% across industry segments while hard-disk drive pricing increases only slightly, creating widening cost arbitrage opportunities. The price gap between HDD and all-flash storage will expand from a 1:4 ratio to 1:10 in 2026, according to Dell’s market analysis. This shift reflects AI training and inference workloads consuming a growing share of enterprise-grade NAND, reducing availability for traditional enterprise deployments.

Availability tightens, lead times extend, and pricing volatility increases as AI infrastructure buildouts outpace NAND production capacity expansion. Enterprises face infrastructure planning challenges as assumptions formed during periods of abundant, cost-stable flash become outdated. Organizations increasingly focus on applying flash performance precisely where it delivers measurable business value rather than across entire storage estates.

PowerScale Architecture: Eliminating Single-Media Dependency

Dell PowerScale supports all-flash, hybrid, and HDD-optimized nodes within a unified OneFS namespace, enabling choice across performance and cost tiers. The platform automatically places data on appropriate tiers NVMe for performance-sensitive AI workloads, hybrid configurations as access patterns shift, and high-capacity HDD for long-term retention while applications interact with a single file system.

PowerScale’s data reduction technologies include the industry’s best scale-out file data reduction guarantee, validated in March 2025 against competitors’ public efficiency claims. The evaluation assessed data reduction, storage capacity, data protection overhead, hardware efficiency, and ENERGY STAR-certified configurations to benchmark cost-per-usable-terabyte metrics.

Dell’s global, resilient supply chain integrates deep, long-term supplier relationships to maintain component availability when flash scarcity constrains competitors. This operational advantage enables PowerScale customers to scale deployments during periods when flash-dependent vendors face allocation limits or extended lead times.

AdwaitX Analysis: Flash-Only Designs Face Structural Vulnerabilities

Platforms from VAST Data and Pure Storage were architected around assumptions of abundant, cost-stable flash supply. These flash-only designs inherently concentrate risk by lacking the ability to tier across media types, amplifying cost exposure as prices rise and increasing sensitivity to supply disruptions.

Some flash-only vendors now encourage customers to reuse or reclaim existing flash media to maintain capacity during supply constraints. This approach introduces risk into AI and mission-critical environments, as flash media has finite endurance and performance behavior becomes less predictable as devices age. Wear accumulation increases exposure to failures, downtime, and data unavailability risks that scale alongside data growth.

Architectures dependent on specialized NAND-based storage-class memory (SCM) cache tiers face compounded constraints. These components are often single-sourced and not broadly available as interchangeable parts, limiting deployment options and slowing expansion when access becomes constrained regardless of downstream capacity.

Technical Specifications: Media Flexibility Framework

| Configuration | Primary Media | Use Case | Key Advantage |

|---|---|---|---|

| All-Flash Nodes | NVMe SSD | Performance-sensitive AI workloads | Optimized latency for inference |

| Hybrid Nodes | NVMe + HDD | Mixed workloads with shifting access patterns | Automatic tiering based on data heat |

| HDD-Optimized | High-capacity HDD | Long-term retention, warm/cold data | 10x lower cost vs. flash in 2026 |

PowerScale’s OneFS operating system automatically manages data placement across tiers without requiring application modifications or manual intervention. The unified namespace presents all storage resources as a single file system, eliminating protocol gateways and simplifying infrastructure management. Built-in data reduction technologies reduce effective storage cost without compromising performance or accessibility.

Infrastructure Planning Amid Prolonged Supply Constraints

Dell positions PowerScale as insurance against pricing volatility and deployment delays affecting flash-dependent storage strategies. The platform’s ability to deliver consistent availability during market disruptions reflects architectural decisions prioritizing media flexibility over flash-only performance optimization.

Organizations evaluating AI storage infrastructure should assess total cost of ownership across multi-year horizons, incorporating projected flash price trajectories and supply risk premiums. Dell recommends engaging account teams to model PowerScale configurations balancing performance requirements against budget constraints in NAND-constrained environments.

The combination of media-flexible architecture and world-class, globally resilient supply chain enables customers to plan and build with confidence as market conditions evolve. The ability to deliver consistently even as markets shift reflects long-term investment in both platform design and operational readiness.

Strategic Outlook: Precision Over Abundance

Modern infrastructure strategies emphasize precision applying the right performance characteristics to the right data at the right time. PowerScale customers are not required to adopt a single media strategy, allowing organizations to balance speed, scale, and economics as requirements evolve.

The intelligent combination of automatic tiering and guaranteed data reduction efficiency helps organizations align infrastructure investment with workload value delivering scale and simplicity while maintaining cost control. In an AI-driven environment where assumptions are being tested, platforms designed for flexibility and backed by dependable supply chains position enterprises to support sustained growth.

Frequently Asked Questions (FAQs)

Why are flash storage prices rising?

AI training and inference workloads consume a growing share of enterprise-grade NAND, reducing availability for traditional enterprise deployments and driving higher prices.

How does Dell PowerScale reduce flash dependency?

PowerScale automatically places data across NVMe and HDD tiers based on access patterns, ensuring flash is used only where it delivers business value.

Why is HDD still relevant for AI storage?

Most AI pipelines include large volumes of warm and cold data that do not require flash performance. HDD provides dramatically lower cost per terabyte for those tiers.

What risks do flash-only storage architectures face?

Flash-only designs lack media tiering capabilities, amplify cost exposure as prices rise, and are more sensitive to supply disruptions.

What is the cost difference between HDD and flash in 2026?

The price gap between HDD and all-flash storage will expand from a 1:4 ratio to 1:10 in 2026.