Key Takeaways

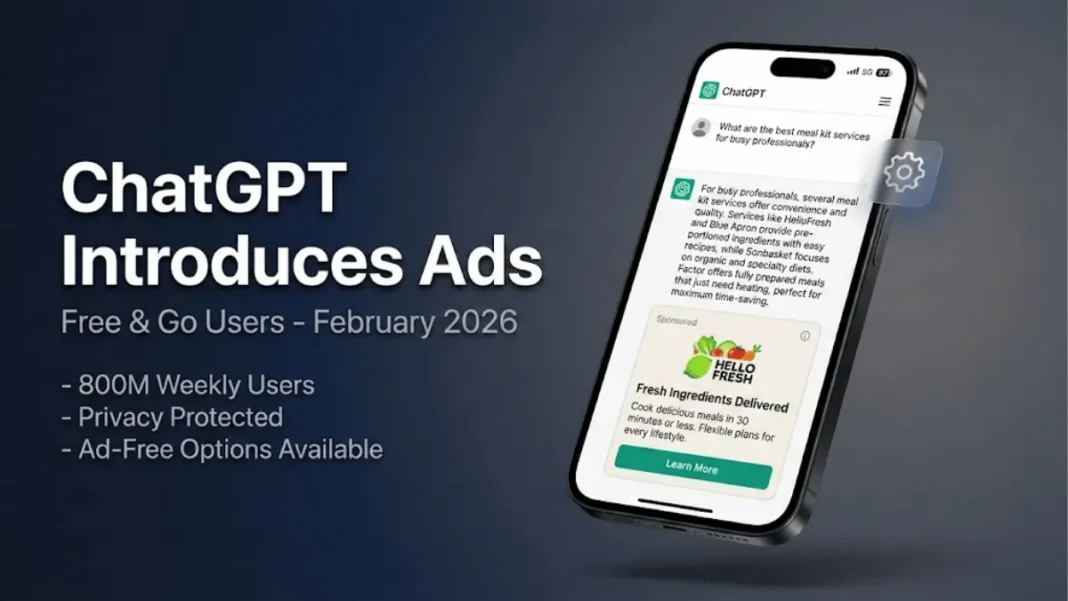

- OpenAI launched ChatGPT ads February 9, 2026 for Free and Go ($8/month) tier users in the US

- Plus, Pro, Business, Enterprise, and Education subscribers remain completely ad-free

- Advertisers never access your conversations only aggregate performance data like views and clicks

- Free users can opt out of ads by accepting fewer daily messages instead

OpenAI crossed a threshold most AI companies avoided: advertising inside conversational AI. The company began testing ads in ChatGPT on February 9, 2026, exclusively for logged-in adult users on Free and Go subscription tiers in the United States. This marks the first time sponsored content appears in the world’s most-used AI chatbot, which serves over 800 million weekly users. The move shifts OpenAI from a subscription-only model to a hybrid revenue approach designed to sustain free access while funding ongoing infrastructure investments.

Who Sees ChatGPT Ads and Who Stays Ad-Free

OpenAI’s advertising test targets two user groups: Free tier users and ChatGPT Go subscribers. Go is a low-cost plan introduced in mid-January 2026 at $8 per month, positioned between the completely free tier and the $20 Plus plan. These users now see sponsored placements at the bottom of ChatGPT responses when advertisers submit products or services relevant to the conversation.

Five subscription tiers remain entirely ad-free: Plus ($20/month), Pro ($200/month), Business, Enterprise, and Education. OpenAI added Education to the protected list after the initial January announcement, confirming that students and institutions using ChatGPT through educational subscriptions won’t encounter ads. Users under 18 also never see ads, regardless of account type.

Free users have an alternative option: opt out of ads completely by accepting a reduced number of daily free messages. OpenAI hasn’t specified the exact message reduction, but this choice allows users who prioritize ad-free experiences without paying for a subscription to maintain some level of free access.

How do ChatGPT ads determine what you see?

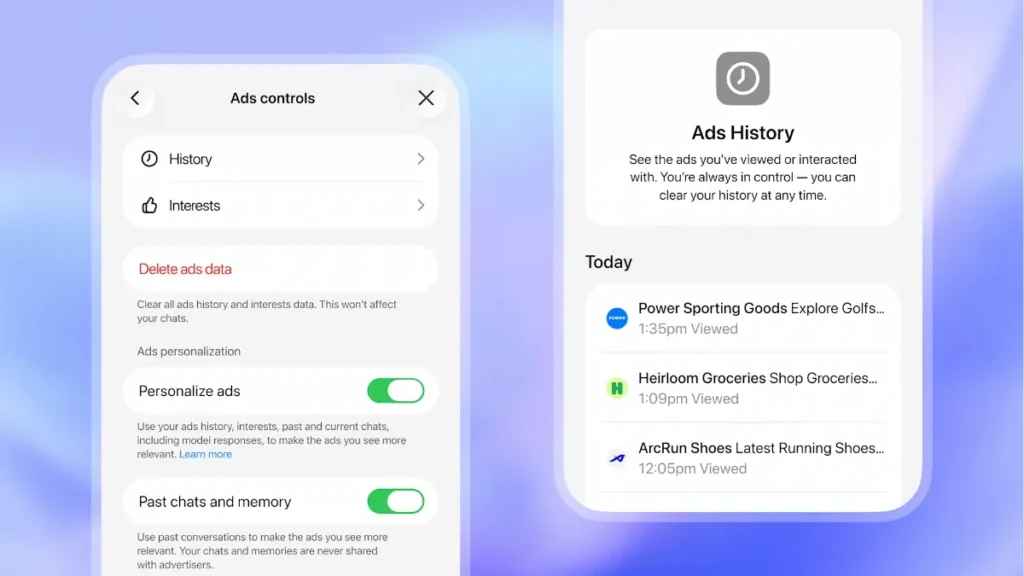

OpenAI matches ads to users through three signals: the current conversation topic, past chat history, and previous ad interactions. If you ask ChatGPT about meal planning, the system might display ads for grocery delivery services or meal kit subscriptions. When multiple advertisers bid on a topic, OpenAI selects the most contextually relevant placement first.

This targeting model differs fundamentally from search advertising. ChatGPT users often engage in exploratory conversations before making decisions researching options, comparing features, or clarifying needs. That places them further along the intent funnel than someone typing a Google search query. For advertisers, this creates access to users actively problem-solving rather than passively browsing.

Privacy Protections and Data Access Limits

Advertisers never see your ChatGPT conversations, chat history, memories, or personal details. OpenAI shares only aggregate performance metrics: total ad views, click counts, and engagement rates across anonymized user groups. This structure prevents individual targeting based on conversation content while still allowing advertisers to measure campaign effectiveness.

Users control their ad experience through several mechanisms. You can dismiss any ad and provide feedback explaining why it wasn’t relevant. Every ad includes an information button showing why OpenAI selected that placement for your conversation. The settings menu offers ad personalization toggles, letting users disable targeting based on past chats and memory. One-tap deletion removes all accumulated ad interaction data from your account.

OpenAI restricts ad placements near sensitive topics: health, mental health, and politics. Conversations touching these subjects trigger exclusion rules that prevent ads from appearing in those sessions. The company also vets advertisers before allowing platform access, aiming to reduce scam risk and misleading promotions.

Answer Independence: How OpenAI Separates Ads from Recommendations

ChatGPT’s answers remain optimized for usefulness, not advertiser interests. OpenAI emphasizes that sponsored placements never influence the organic response text ads appear below answers, visually separated and labeled as “sponsored”. This design mirrors Google’s search results separation between organic listings and paid placements.

The independence principle addresses the core trust issue in conversational AI advertising. Users ask ChatGPT for advice on purchases, career decisions, and personal planning. If answers favored advertisers, the product’s utility collapsed. OpenAI states this explicitly: “ChatGPT’s answers remain independent and unbiased” regardless of ad presence.

Early advertiser costs reflect premium positioning. OpenAI requires a $200,000 minimum commitment for initial ChatGPT ad campaigns. Media buyers report costs around $60 per 1,000 ad views (CPM) during the US test phase. These rates exceed typical social media CPMs, which average $7-$15, suggesting OpenAI positions ChatGPT ads as high-intent placements rather than awareness-building inventory.

Why OpenAI Chose Advertising Now

ChatGPT’s infrastructure costs forced a revenue decision. Keeping Free and Go tiers “fast and reliable requires significant infrastructure and ongoing investment,” OpenAI stated in the February announcement. Only 5-10% of ChatGPT’s 800 million weekly users pay for subscriptions. That leaves the vast majority generating compute costs without direct revenue contribution.

Advertising funds three objectives: broader free access, reliability improvements for free users, and continued model intelligence upgrades. OpenAI frames ads as the mechanism enabling sustainable free AI rather than purely profit-seeking. The company had previously outlined advertising principles in a January 16, 2026 blog post, setting user trust and conversation privacy as non-negotiable requirements before implementation.

Competitor pressure also influenced timing. Anthropic, OpenAI’s primary rival in conversational AI, aired a Super Bowl commercial on February 8, 2026 one day before ChatGPT ads launched promising Claude would remain ad-free. The commercial directly targeted OpenAI’s advertising plans, positioning Claude as the privacy-focused alternative. Hours after the Super Bowl spot aired, OpenAI officially began the ChatGPT ad test.

What Advertisers Access Through ChatGPT Placements

OpenAI’s advertiser portal (openai.com/advertisers) accepts applications from businesses interested in sponsored placements. The company describes the opportunity as connecting with users “actively researching and ready to take action”. Initial test participants meet the $200,000 minimum spend requirement, limiting early access to large brands and enterprises.

Ad formats currently consist of text and image placements below ChatGPT responses. OpenAI plans to “evolve our advertising program to support additional formats, objectives and buying models” over time. This suggests future options may include video placements, interactive elements, or direct transaction capabilities within ChatGPT.

Businesses gain access to users at decision-making moments. Someone asking ChatGPT to compare laptop specifications or research vacation destinations demonstrates active purchase intent. This differs from social media advertising, where users scroll recreationally without immediate buying plans. For B2B advertisers, ChatGPT conversations about software tools, project management, or business strategy create opportunities to reach decision-makers during actual work sessions.

User Reaction and Industry Response

The February 9 launch date followed weeks of anticipation after OpenAI’s January announcement. Privacy advocates raised concerns about conversation data usage despite OpenAI’s assurances that advertiser access remains limited to aggregate metrics. The timing one day after Anthropic’s anti-ad Super Bowl spot intensified scrutiny of OpenAI’s monetization strategy versus competitors positioning themselves as ad-free alternatives.

OpenAI characterizes the February rollout as a “test” rather than an official launch. This framing suggests the company anticipates adjustments based on user feedback and performance data before expanding ads to international markets or additional user segments. The test phase allows OpenAI to measure dwell time changes, user retention rates, and satisfaction scores before committing to advertising as a permanent revenue pillar.

Free users who dislike ads have three choices: accept ads with full message limits, opt out of ads for reduced daily messages, or upgrade to Plus at $20 monthly. Go subscribers at $8 monthly must either tolerate ads or upgrade to Plus or Pro to eliminate them. This pricing structure creates a $12 monthly premium for ad removal, positioning advertising as the subsidization mechanism for lower-cost AI access.

Long-Term Advertising Strategy and Format Evolution

OpenAI’s blog post hints at expanded advertising capabilities beyond current text-image placements. The company mentions building “new ways for businesses to interact with consumers in ChatGPT,” suggesting future formats may include conversational ads that integrate with the chat interface. This could allow sponsored responses where users ask follow-up questions to advertisers directly within the conversation flow.

The conversational nature of ChatGPT creates advertising possibilities unavailable in traditional formats. Users might ask ChatGPT to compare products, explain features, or recommend options for moments where sponsored placements could provide direct value rather than interrupting the experience. OpenAI’s challenge is maintaining the separation between organic recommendations and paid placements as ad formats become more sophisticated.

International expansion remains unannounced. The current test restricts ads to the United States, but OpenAI operates ChatGPT globally. Expanding advertising to Europe, India, and other markets introduces regulatory complexity around data privacy, advertising standards, and age verification. India’s large ChatGPT user base presents a significant monetization opportunity, but requires compliance with local digital advertising regulations and payment infrastructure for regional advertisers.

Frequently Asked Questions (FAQs)

When did the February 2026 Discover core update start rolling out?

The update launched February 5, 2026 at 9:00 AM Pacific Time for English-language US users. The complete rollout takes up to 2 weeks, with global expansion planned for coming months.

Which content types are most affected by this update?

Clickbait headlines, sensational content, and international publishers targeting US audiences without US-based operations face potential declines. In-depth original content from local sources with demonstrated topic-level expertise may see increased visibility.

How does Google determine local relevance in Discover?

Google’s systems evaluate website location and prioritize showing content to users from websites based in their own country. Publishers located in the user’s country receive prioritization over international sources.

Can websites with multiple topics still succeed in Discover?

Yes. Google evaluates expertise on a topic-by-topic basis rather than domain-wide. A local news site with a strong gardening section competes equally with dedicated gardening websites for gardening-related Discover placements.

Should publishers make immediate changes to respond to this update?

Google recommends focusing on quality content that aligns with the update’s priorities: accurate headlines, locally relevant topics for your website’s location, and demonstrated expertise in specific subject areas. Publishers should avoid making reactive changes and instead ensure existing content meets these quality standards.

How long will the rollout take?

The rollout completes within up to 2 weeks from the February 5 launch date. Global expansion to all countries and languages will occur in the months ahead without a specific timeline.

Does this update apply to Google Search results?

This is a Discover-specific core update. Google’s announcement focuses on the Discover feed experience and does not mention changes to traditional Google Search ranking algorithms.

What resources should publishers use for guidance?

Google recommends reviewing the “What publishers should know about Google’s core updates” documentation and the “Get on Discover” help page. Publishers can join the Search Central help community or connect via LinkedIn for specific questions.