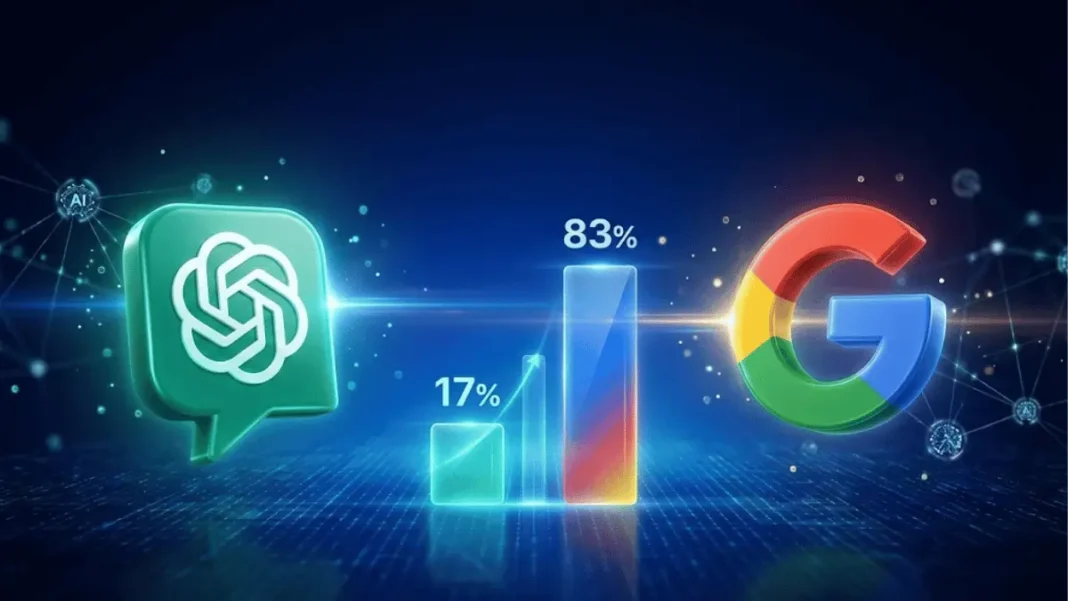

OpenAI’s ChatGPT has secured 17-18% of the global query market as of January 2, 2026, marking the first time in over two decades that a competitor has achieved double-digit share against Google’s search dominance. While Alphabet maintains 78-80% of searches, the shift signals a fundamental change in how users interact with information from clicking through links to receiving synthesized, cited answers directly.

The New AI Search Battleground

ChatGPT’s weekly active user base has reached 800-900 million, vastly outpacing Google’s Gemini, which sits at approximately 35% of that scale on web platforms and 40% on mobile. Despite fewer users, ChatGPT demonstrates deeper engagement, with average session durations of 13 minutes compared to Google’s 6 minutes. However, competition has intensified following Alphabet’s deployment of Gemini 3 on November 18, 2025, and Gemini 3 Flash on December 17. According to data published January 1, Gemini’s generative AI web traffic share surged from 5.4% to 18.2% over the past year, while ChatGPT’s share in that category dropped from 87.2% to 68%.

Andreessen Horowitz partner Olivia Moore described the market as trending toward “winner take all, or at least winner take most,” noting that “things are changing very quickly”. Desktop user growth data reveals Gemini is expanding at 155% year-over-year compared to ChatGPT’s 23%, with Gemini’s growth rate accelerating monthly driven significantly by viral image models like Nano Banana.

How Usage Patterns Differ

A strategic divide has emerged between the platforms based on query intent. Google retains dominance in transactional and navigational queries users seeking local services, specific purchases, or business information where its Maps integration and extensive local database provide clear advantages. ChatGPT has captured informational and creative searches, where conversational AI excels at synthesizing complex answers. Research firm Semrush data shows over 88% of queries triggering AI-powered results are informational, compared to just 1.76% for transactional searches.

Key differences include:

- Result format: Google provides ranked links with snippets; ChatGPT delivers conversational responses with inline citations

- Context handling: ChatGPT maintains conversation context across multiple queries; Google treats each search independently

- Engagement depth: ChatGPT users spend significantly longer per session, indicating thorough exploration versus quick lookups

Publisher Revenue Crisis

The shift toward AI-synthesized answers has created what industry observers call a “zero-click” reality, with over 65% of searches now resolved directly on results pages without users clicking through to source websites. Publishers report traffic declines of 20-60% on average, translating to approximately $2 billion in annual advertising revenue losses across the sector. Research from Ahrefs examining 300,000 keywords found AI-generated summaries reduce organic clicks by 34.5% when present in search results.

This crisis has spawned Generative Engine Optimization (GEO), a new practice where publishers compete to be cited within AI responses rather than ranking in traditional search results. Princeton University researchers who coined the term found that adding citations, quotations, and statistics boosts source visibility by over 40% across various queries. Both OpenAI and Google have struck licensing deals with major media companies, though smaller independent creators face mounting challenges navigating this landscape.

What Comes Next

Several critical factors will shape 2026’s competitive dynamics. Gemini 3’s advanced video and image models, particularly the viral Nano Banana tool may provide significant advantages, since there’s “always nearly infinite demand” for multimodal capabilities among both professional and everyday users. ChatGPT’s internal app store, which launched with partners including Spotify and Zillow, could be its “defining question for the next year,” according to Andreessen Horowitz partners. The platform’s software development kit allows developers to build custom apps, potentially transforming ChatGPT into an app store-like ecosystem.

Google’s defensive advantages remain substantial billions of daily users, deep device integration, and years of optimization provide significant moats. ChatGPT Enterprise usage grew eightfold in 2025, and corporate adoption could translate into increased consumer usage as employees become familiar with the platform. The European Commission launched a formal antitrust investigation on December 9, 2024, examining whether Google violated EU competition rules by using publisher content for AI purposes without appropriate compensation.

Featured Snippet Boxes

How did ChatGPT reach 17% market share so quickly?

ChatGPT achieved this share through rapid user adoption driven by conversational AI that delivers direct answers rather than link lists. Weekly active users reached 800-900 million within three years, the fastest adoption curve in technology history.

Does ChatGPT provide more accurate search results than Google?

It depends on query type. Google maintains advantages in transactional, local, and commercial searches with its extensive business database and Maps integration. ChatGPT excels at informational queries requiring synthesis and context across multiple exchanges.

What is Generative Engine Optimization (GEO)?

GEO is the practice of optimizing content to be cited by AI language models rather than ranked in traditional search. Princeton researchers found adding citations, quotations, and statistics increases visibility by 40% in AI responses.

How much revenue are publishers losing to AI search?

Publishers face approximately $2 billion in annual advertising revenue losses, with traffic declining 20-60% on average. AI Overviews reduce organic clicks by 34.5% when present, creating what’s called a “zero-click” search environment.