Quick Brief

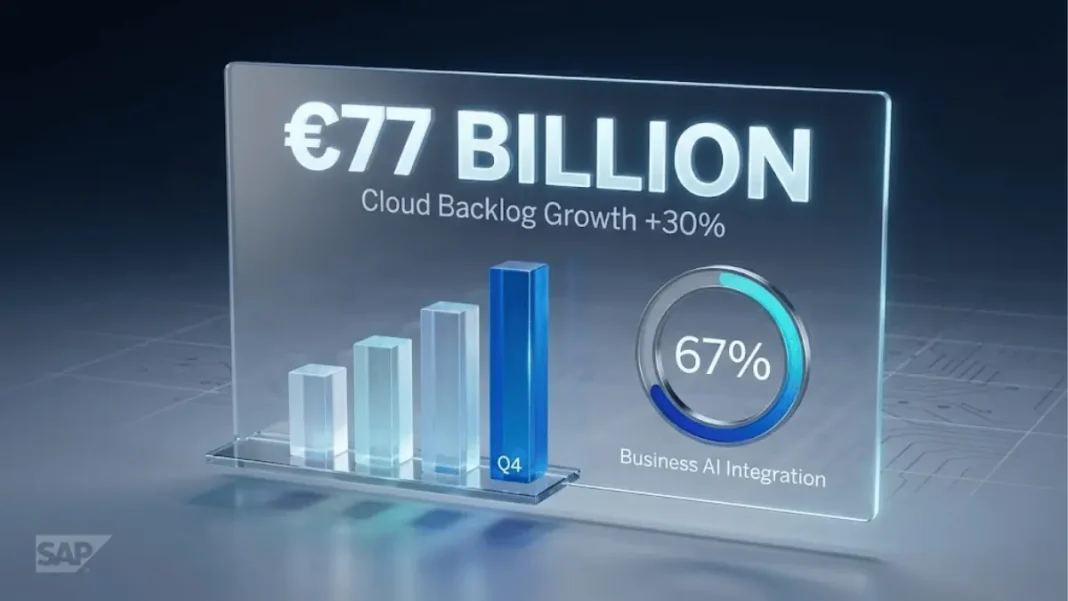

- SAP’s total cloud backlog surged 30% to record €77 billion in Q4 2025

- Business AI features appeared in two-thirds of Q4 cloud order entry

- Free cash flow nearly doubled to €8.24 billion from €4.22 billion year-over-year

- Cloud ERP Suite revenue climbed 32% at constant currencies to €18.12 billion

SAP just dismantled expectations for enterprise software growth and artificial intelligence sealed the deal. The German software giant closed 2025 with a total cloud backlog reaching €77 billion, a 30% year-over-year jump driven by Business AI adoption across two-thirds of fourth-quarter cloud contracts. This marks the strongest quarterly cloud performance in SAP’s transformation journey, with current cloud backlog hitting €21.05 billion, up 25% at constant currencies.

Business AI Becomes Primary Growth Driver

SAP Business AI appeared in 67% of Q4 2025 cloud order entry, representing a 20-percentage-point increase from the previous quarter. Among the 50 largest deals signed in Q4, 90% included either AI capabilities or SAP Business Data Cloud integration. CEO Christian Klein attributed this momentum to enterprises seeking resilience amid geopolitical volatility, stating that customers recognize they “don’t gain value by developing custom AI agents or applying commodity large language models on top of transactional business applications”.

The AI adoption translated directly to deal complexity. Nearly two-thirds of contracts exceeding €1 million in Q4 involved four or more lines of business, a 25-percentage-point jump that signals customers are purchasing across SAP’s portfolio rather than isolated products. One customer eliminated over 200 self-built predictive models after implementing SAP’s AI foundation and Knowledge Graph.

What sets SAP Business AI apart from competitors?

SAP Business AI leverages SAP’s access to what CEO Klein calls “the world’s largest volume of business data” through its ERP and Business Suite footprint. Unlike generic AI tools bolted onto applications, SAP integrates AI directly into the application layer where business processes execute. This architectural advantage allows enterprises to govern and scale AI across organizations without managing multiple point solutions.

Cloud Revenue Performance Exceeds Targets

Cloud revenue reached €21.02 billion for FY 2025, representing 26% growth at constant currencies. Cloud ERP Suite revenue, SAP’s strategic software-as-a-service portfolio, grew 32% to €18.12 billion. Fourth-quarter cloud revenue alone increased 26% to €5.61 billion compared to €4.71 billion in Q4 2024.

Total revenue climbed 11% at constant currencies to €36.8 billion, with predictable revenue reaching 86% of the total mix. This shift underscores SAP’s transformation from perpetual licensing to recurring subscription models. Software license revenue declined 27% to €990 million as customers migrated to cloud-based products.

Profitability and Cash Flow Surge

IFRS operating profit soared 111% to €9.83 billion in FY 2025, while non-IFRS operating profit increased 28% (31% at constant currencies). Free cash flow nearly doubled to €8.24 billion from €4.22 billion, driven by higher profitability and reduced restructuring payments following the 2024 workforce transformation program.

CFO Dominik Asam highlighted the performance reflected “focused execution, financial discipline, and continued trust our customers place in us as the North Star for their digital transformation”. The company announced a new two-year share repurchase program worth up to €10 billion.

Net income jumped 17% in Q4 2025 to €1.89 billion, rising from €1.61 billion in Q4 2024. For the full year, net income surged from €3.15 billion in 2024 to €7.49 billion in 2025.

| Metric | Q4 2025 | FY 2025 | Growth (YoY) |

|---|---|---|---|

| Total Cloud Backlog | €77B | €77B | +30% |

| Current Cloud Backlog | €21.05B | €21.05B | +25% |

| Cloud Revenue | €5.61B | €21.02B | +26% |

| Free Cash Flow | – | €8.24B | +95% |

| Total Revenue | – | €36.8B | +11% |

Market Reaction and 2026 Outlook

SAP shares fell 18% in pre-market trading following the earnings announcement, as cloud backlog and revenue guidance for 2026 fell short of investor expectations. The company projects 2026 cloud revenue growth above 25% at constant currency and free cash flow around €10 billion.

For 2026, SAP expects non-IFRS operating profit between €11.9 and €12.3 billion, indicating 14% to 18% growth from €10.42 billion in 2025. The company anticipates slight moderation in constant-currency current cloud backlog growth from 25% in 2025.

How will AI impact SAP’s cost structure?

SAP launched an internal AI transformation program targeting approximately €2 billion in cost efficiencies by the end of 2028, equal to 15% to 20% of addressable costs. CEO Klein emphasized that “AI isn’t just about technology, it first needs to be enabled by our people“. The company has already completed its 2024 workforce transformation program, which generated total expenses of approximately €3.2 billion.

Strategic Wins Highlight AI Differentiation

SAP’s AI-driven wins include a major retail customer that scrapped over 200 predictive models after implementing SAP’s AI foundation. Swedish retailer H&M adopted a prototype for personalized shopping combining large language models with SAP’s AI foundation to integrate purchase history and browsing behavior. Klein stated SAP won the H&M deal based on last-mile delivery capabilities beyond cloud migration alone.

The fourth-quarter acceleration reflected what Klein termed “strong foundation” deals with high revenue ramps in outer years. This suggests contracts carry multi-year commitments with expanding workloads as customers scale AI deployments.

Will SAP maintain its AI lead against Microsoft and Oracle?

SAP’s competitive advantage rests on three structural factors. First, controlling the application layer where business processes run enables built-in AI rather than third-party integrations. Second, SAP’s ERP footprint provides access to enterprise transaction data competitors cannot replicate. Third, the company bets enterprises will favor integrated solutions over managing multiple AI point products as governance and compliance requirements intensify.

CEO Klein directly addressed competitive concerns, stating “we are winning deals because of AI, we are not losing deals because of AI“. Among C-suite leaders, 66% report AI adoption moving faster than expected, according to a September 2025 Accenture study.

Limitations and Considerations

Despite strong cloud growth, SAP’s Q4 2025 earnings per share came in at $1.62, below the forecasted $1.76, and revenue of $9.68 billion missed the anticipated $11.35 billion. The EPS surprise registered -7.95%, while revenue surprise stood at -14.71%. Fourth-quarter IFRS and non-IFRS operating profit growth faced a negative impact of approximately €100 million related to 2025 workforce transformation expenses, plus $200 million in Teradata litigation costs.

CEO Klein acknowledged a “rough start to the year” due to geopolitical unrest, though the company overcame early headwinds to post 8% annual growth. Software license revenue decline of 27% reflects industry-wide cloud migration trends but pressures short-term top-line expansion.

Frequently Asked Questions (FAQs)

What was SAP’s total cloud backlog in Q4 2025?

SAP’s total cloud backlog reached a record €77 billion in Q4 2025, representing 30% year-over-year growth at constant currencies. This backlog reflects future contracted revenue from cloud subscriptions.

How much did SAP’s free cash flow increase in 2025?

SAP’s free cash flow nearly doubled to €8.24 billion in FY 2025 from €4.22 billion in 2024. The increase resulted from higher profitability and lower restructuring payments.

What percentage of SAP’s Q4 deals included Business AI?

Business AI features appeared in two-thirds (67%) of SAP’s Q4 2025 cloud order entry. Among the 50 largest deals, 90% included either AI or SAP Business Data Cloud.

Did SAP meet revenue expectations for Q4 2025?

SAP missed Q4 2025 revenue expectations, reporting $9.68 billion against forecasted $11.35 billion. However, the company met annual revenue outlook and exceeded non-IFRS operating profit and free cash flow targets.

What is SAP’s cloud revenue growth outlook for 2026?

SAP projects 2026 cloud revenue growth above 25% at constant currency. The company expects non-IFRS operating profit between €11.9 and €12.3 billion, reflecting 14% to 18% growth.

How does SAP Business AI differ from generic AI tools?

SAP Business AI integrates directly into the application layer where business processes execute, rather than functioning as a separate overlay. It accesses SAP’s enterprise transaction data through ERP and Business Suite footprints, providing context generic large language models cannot replicate.

What is SAP’s share repurchase program size?

SAP announced a new two-year share repurchase program with volume up to €10 billion.