Amazon America’s largest private employer is at a technological crossroads. By 2030, the company aims to “avoid hiring” up to 600,000 people, instead relying on an army of warehouse robots and advanced AI systems to keep its fulfillment empire running at breakneck speed. This seismic shift promises lower costs and faster delivery, but what’s the real impact on people, communities, and the wider job market? In this article, we’ll unpack the numbers, technologies, personal stories, and policy debates shaping Amazon’s automation wave and help you navigate what it means for the future of work.

Table of Contents

What Is Driving Amazon’s Automation Wave?

Warehouse work is physically demanding and highly repetitive. As consumer expectations for rapid shipping rise, Amazon needs speed, precision, and flexibility without escalating labor costs. Robotics, “cobots” (collaborative robots), and AI-controlled systems have matured to the point where they can handle most sorting, packing, and conveyor jobs with greater efficiency than humans in many environments.

The Numbers Behind the Transformation

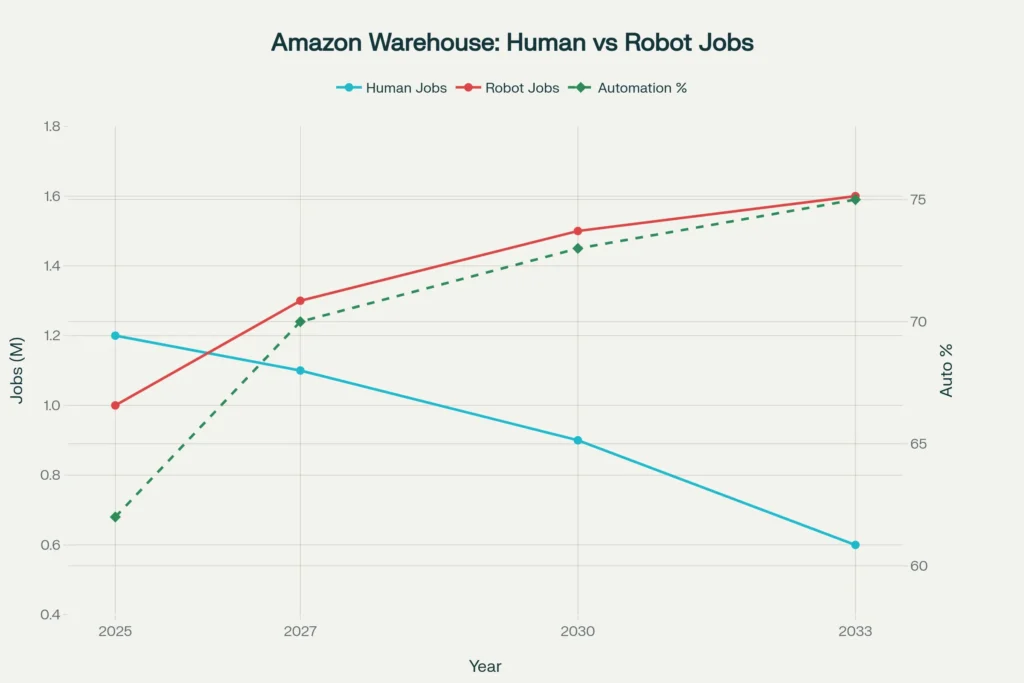

- By 2025: ~1.2 million U.S. humans on Amazon’s payroll, ~1 million robots aiding in fulfillment centers.

- By 2033: Robots projected to surpass humans in number, with the company targeting at least 75% automation in major facilities, doubling throughput per shift.

- Amazon’s internal goal: “Avoid hiring” 600,000 new workers for roles where robots or cobots can do the job for a projected annual cost savings of $4 billion.

- Pilot facilities in Shreveport and Stone Mountain test new automation models, with significant drops in human hiring and spikes in productivity.

| Year | Human Employees (Millions) | Robot Employees (Millions) | % Operations Automated | Notes |

|---|---|---|---|---|

| 2025 | 1.2 | 1.0 | 62% | At inflection point; robot workforce nearly equals humans. Productivity up, hiring slowing. |

| 2027 | 1.1 | 1.3 | 70% | Automation ramp, pilot sites lead shift. Target: 160,000 fewer hires. |

| 2030 | 0.9 | 1.5 | 73% | Major automation rollouts; hiring freezes in several regions. |

| 2033 | 0.6 | 1.6 | 75% | Goal: Avoid hiring 600k+ new workers; robots surpass humans. Union pressure increases. |

Key Technologies: From Cobots to AI Vision

- Autonomous mobile robots (AMRs) on warehouse floors

- AI-powered sorting and inventory systems

- Cobots working side-by-side with people for handling fragile or irregular items

- Computer vision detecting errors and optimizing shelves in real time

- Machine learning algorithms scheduling, routing, and allocating labor

Which Amazon Jobs Are Most at Risk?

Not all roles are equally vulnerable. Based on multiple industry studies and leaked internal roadmaps, here’s what’s at greatest risk:

Top 5 Roles Likely to Be Automated

- Package Sorter: AI/robotic arms excel at sorting boxes faster and with fewer errors.

- Stower: Robots can place goods on shelves and retrieve them for packing using automated tracks.

- Picker: AMRs find and deliver items for shipment, reducing walking for human workers.

- Packer: Automated packing can now handle standardized items at scale.

- Quality Assurance: AI vision and sensors handle routine checks, flagging issues for humans only when needed.

Short Answer Box:

Q: Which Amazon jobs are most likely to be replaced by robots?

A: Package sorting, stowing, picking, packing, and entry-level quality assurance roles are at the top of Amazon’s automation roadmap for robotic replacement by 2030.

Mini Case Study: Inside Stone Mountain & Shreveport

In two pilot warehouses, Amazon replaced over 30% of manual sorting and picking positions with cobots and AMRs. Human employees transitioned to technical oversight and troubleshooting roles, but required retraining. Initial data shows a 40% drop in repetitive motion injuries but also a 25% reduction in entry-level job postings.

Pros & Cons – Repetitive Task Relief vs Job Security

| Pros | Cons |

|---|---|

| Reduced injuries and fatigue | Fewer entry-level opportunities |

| Faster throughput and lower costs | Skills mismatch for displaced staff |

| More consistent results | Community impact in warehouse towns |

| Upskilling pathways for remaining staff | Union backlash, morale issues |

How Will This Affect Workers and Communities?

Economic Fallout & Community Events

Local economies in warehouse-heavy regions, such as rural Tennessee and parts of Ohio, may face challenges as low-skilled warehouse jobs become scarce. Civic leaders are calling for Amazon to fund retraining and upskilling programs for displaced workers.

Retraining, Upskilling, and New Tech Roles

Amazon claims that 25% of affected workers could move into higher-paying technical maintenance, robotics calibration, or data operations roles if they opt for upskilling and retraining partnerships offered on-site. Success depends on education access and willingness to change.

Union Response & Labor Advocacy

Major labor unions, including the Teamsters, have increased pressure on Amazon to guarantee fair transition plans, offering laid-off staff a chance to join community college programs or receive severance for job loss directly attributable to automation. Ongoing negotiations in 2025 focus on community funds and local reinvestment.

Operational Impact: Delivery, Efficiency, and Costs

Will Automation Improve Delivery Speeds?

Early data at pilot sites show that average “order-to-ship” times dropped by 18% after full robotics deployment, especially during peak holiday weeks. Omnichannel operations benefit from real-time data and fewer bottlenecks.

Amazon’s Cost Per Item – What It Means for Consumers

Automation drops the cost of fulfillment by 15–30 cents per item shipped, allowing Amazon to maintain competitive pricing and invest in next-gen logistics tech, according to Morgan Stanley.

Short Answer Box:

Q: Will Amazon’s robot plan make deliveries faster and cheaper?

A: Yes. Automated warehouse operations have cut order-to-ship times by up to 18% and decreased per-item shipping costs by 15–30 cents, according to pilot facility data.

Frequently Asked Questions (FAQs)

How many jobs are on the line?

Up to 600,000 potential roles may be avoided not all firings, but fewer new hires and attrition by 2033.

Will Amazon still hire seasonal workers?

Yes, but mainly for tech oversight, troubleshooting, and customer service functions.

Are robots causing injuries or making warehouses safer?

Automated robots reduce repetitive injuries but pose new risks, like collisions; safety protocols are evolving rapidly.

Will displaced employees get help retraining for tech jobs?

Amazon and several state governments offer retraining programs, but uptake and effectiveness vary by site and region.

Are these changes unique to Amazon?

No; Walmart, Target, and other global retailers are piloting automation, but Amazon’s scale and speed set the precedent.

The Bottom Line

By 2030, Amazon will rely on robots for 75% of its warehouse operations, aiming to avoid hiring up to 600,000 people. Most routine jobs sorter, stower, picker, packer face automation risk. While costs and delivery speeds improve, displaced workers need better retraining, and communities must prepare for rapid job market shifts.

Featured Snippet Boxes

How many Amazon jobs will robots replace by 2030?

Amazon aims to avoid hiring up to 600,000 U.S. roles by maximizing robotics and automation in its warehouses by 2030.

What types of jobs are most at risk from automation at Amazon?

Package sorting, stowing, picking, packing, and entry-level QA roles are top priorities for robotic replacement.

Does Amazon’s robot plan mean layoffs?

Not all jobs will be cut. Amazon will mainly reduce new hires and let roles disappear through attrition.